As Manitoba prepares to unveil its latest budget, anticipation looms over the fiscal measures the NDP government will introduce in its first budget since securing victory in last October’s election. With a focus on tax incentives, including provisions for the automotive industry, and potential adjustments to property and income taxes, stakeholders eagerly await the unveiling of budgetary priorities. Amidst ongoing fiscal challenges and the government’s ambitious policy agenda, the forthcoming budget represents a pivotal moment for Manitoba’s economic trajectory.

Manitoba’s NDP government is gearing up to unveil its latest budget, poised to introduce a mix of tax incentives and increases, with a particular focus on the automotive sector, marking its inaugural budget post last October’s election victory.

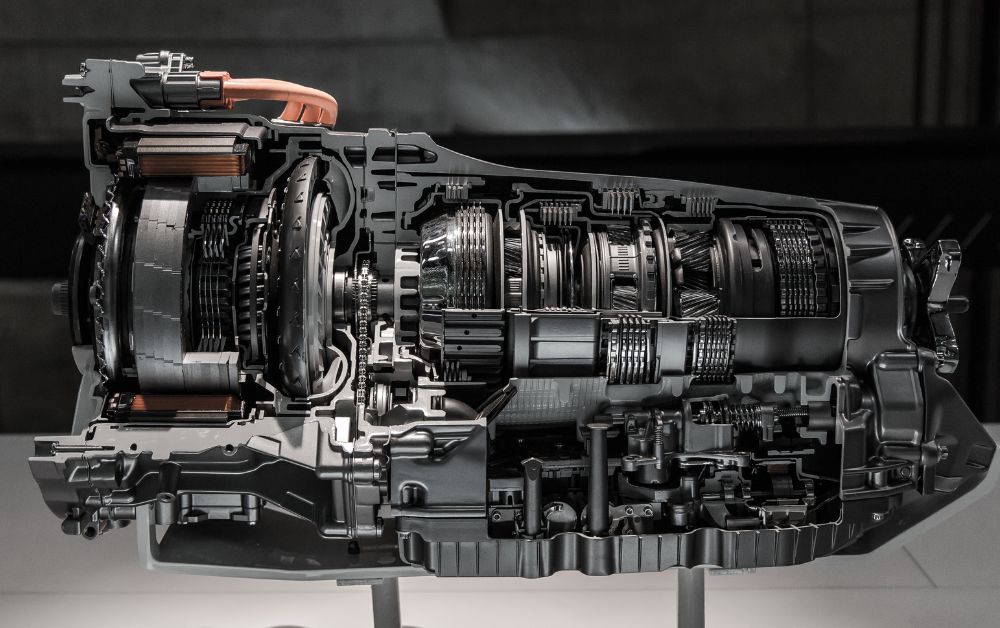

Hints from government sources suggest the forthcoming fiscal blueprint, set for release this Tuesday, may extend Manitoba’s fuel-tax hiatus, originally implemented on January 1 for a six-month period. Speculation also points towards the fulfillment of election pledges, including the introduction of a rebate of up to $4,000 for electric vehicle (EV) purchasers.

Anticipated budgetary highlights encompass a doubling of tax credits for fertility treatments, provisions for free prescription birth control, rebates up to $4,000 for EV buyers, and a $300 rebate for security camera purchases. Additionally, commitments to enhance renter support are expected to materialize.

Finance Minister Adrien Sala emphasized, “This budget is set to deliver on our electoral promises,” during a pre-budget event, signaling the government’s dedication to its campaign commitments.

However, the proposed budget may entail adjustments for higher-income individuals and owners of high-value properties. The government is reportedly considering revisions to previous tax cuts, aiming for a more progressive tax structure, wherein higher-income earners and owners of pricier homes would incur greater tax burdens.

In terms of property tax modifications, a shift towards a singular flat credit system is speculated, with adjustments expected to vary homeowners’ tax liabilities. Meanwhile, discussions around income tax reforms are ongoing, with potential measures targeting high-income brackets.

Amidst ongoing fiscal challenges, Manitoba continues to grapple with persistent deficits, with the previous fiscal year forecasting a deficit nearing $2 billion. The impending budget, according to Paul Thomas, a political studies professor, presents a critical juncture for the government to demonstrate fiscal responsibility while delivering on its progressive policy agenda.

The NDP’s efforts to alleviate the deficit are bolstered by the recent settlement of a class-action lawsuit related to federal benefits for children in the welfare system, providing a financial cushion. Additionally, favorable water levels could positively impact revenue projections, following last year’s drought conditions, which significantly impacted hydroelectricity generation.

As anticipation mounts, all eyes are on Manitoba’s forthcoming budget, expected to strike a delicate balance between progressive reforms and fiscal prudence in navigating the province’s economic landscape.

With the release of Manitoba’s budget imminent, stakeholders are poised to witness the government’s strategy to balance progressive reforms with fiscal responsibility. As the NDP fulfills campaign promises and navigates the province’s economic landscape, the budgetary decisions made will shape Manitoba’s trajectory in the coming years. Whether it’s the anticipated EV incentives or adjustments to taxation, the budget will undoubtedly spark discussions on the province’s economic future and the government’s ability to deliver on its commitments.